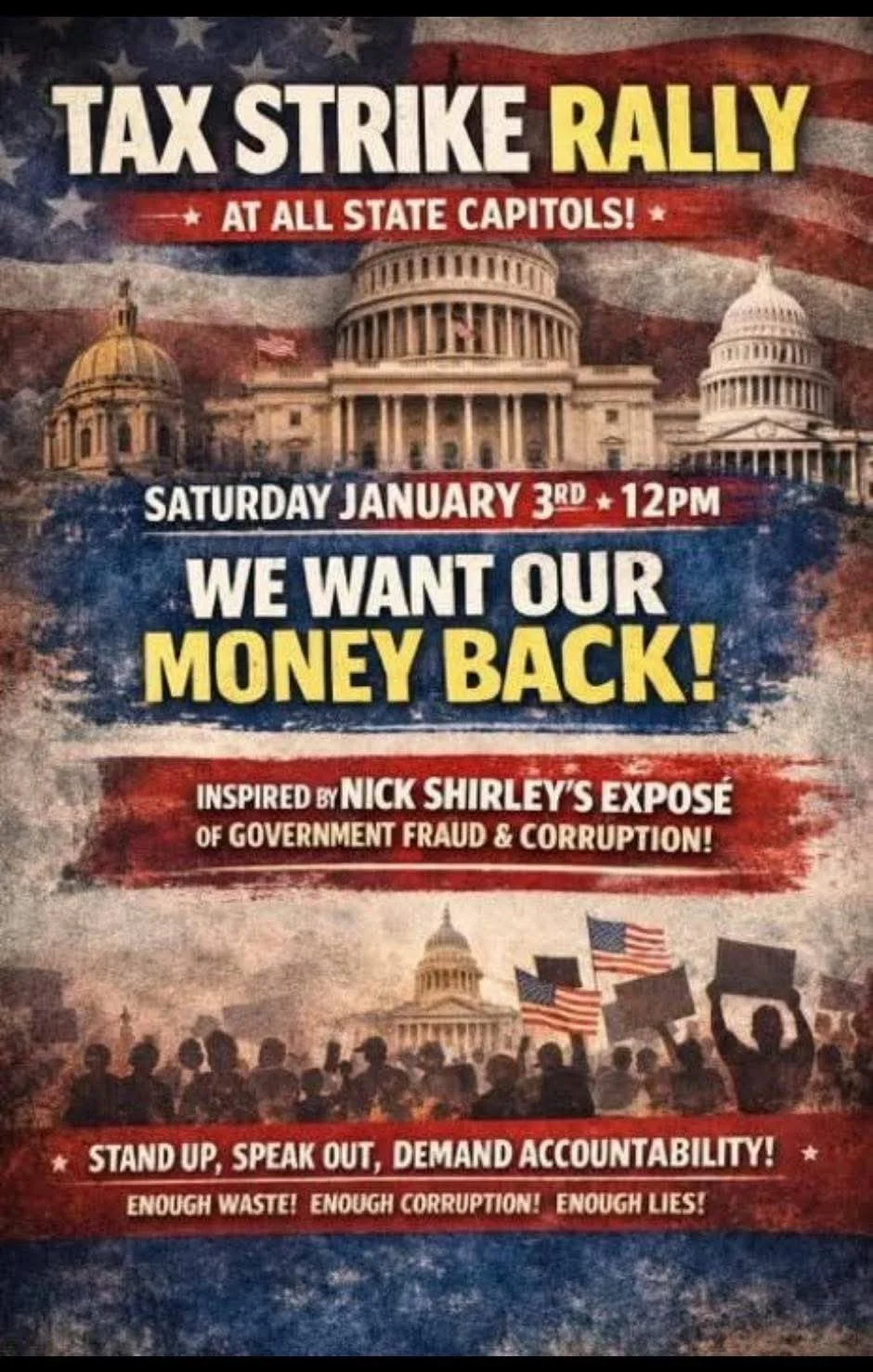

Meanwhile, the foundational principles underlying taxation—public trust, accountability, and consent—are increasingly viewed as having broken down. Tax burdens continue to rise through income, property, and sales taxes, yet many taxpayers report declining public services, deteriorating infrastructure, and repeated examples of waste, mismanagement, and fraud. At the same time, government budgets and spending decisions often lack transparency, with limited public access to records and few visible consequences for misconduct. This has contributed to a growing perception that taxes are being demanded without clear evidence that existing funds are being managed responsibly.